The Cash Flow Budget is a crucial aspect of any business plan, involving detailed planning of expected income and expenses. This guide is indispensable for long-term cash flow budgets.

In this article, we will explore the significance of the Cash Flow Budget and its key components: cash inflows and outflows. Furthermore, we will delve into the process of creating a cash flow budget estimate and illustrate the concept using a gym as an example.

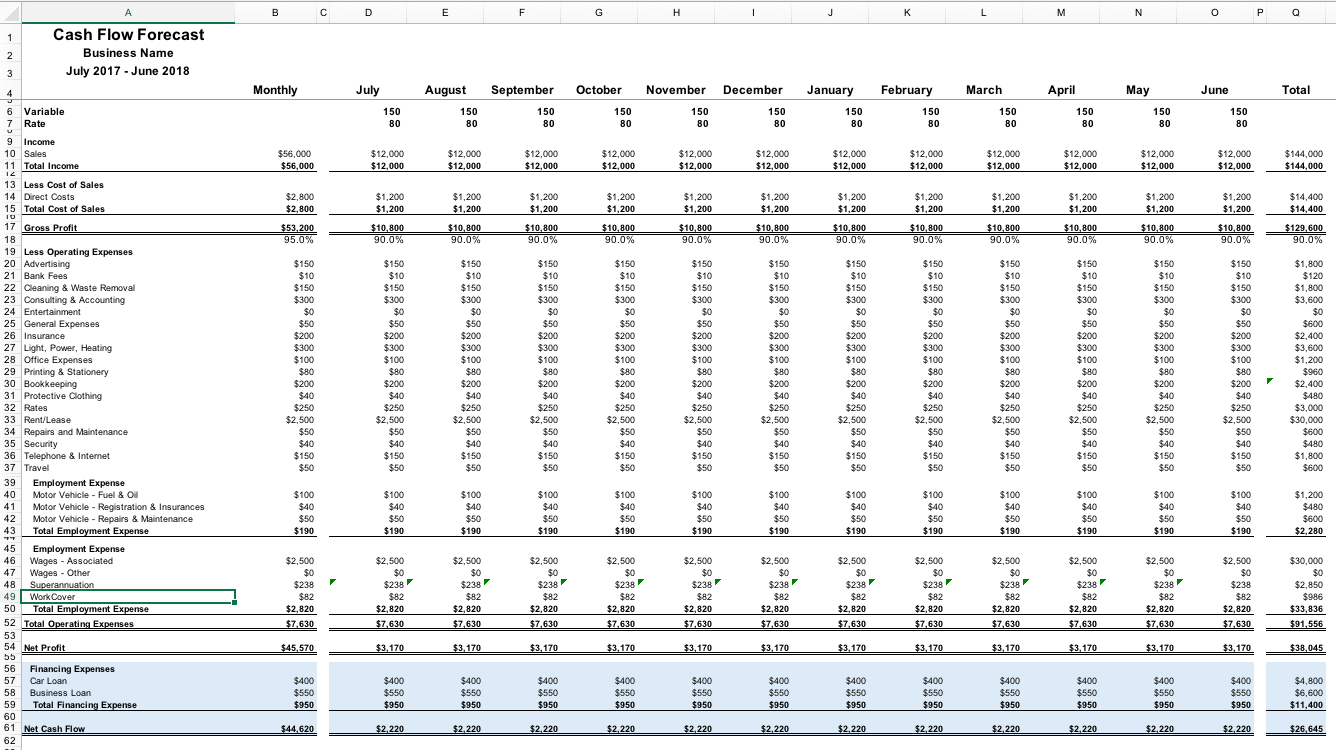

Download your copy of my Cash Flow Budget Template right here!

Cash Flow Budget

A cash flow budget is a financial plan that predicts cash inflows and outflows over a specific period, usually a month, quarterly, or yearly. Businesses need to monitor and keep cash flow budgets to manage their cash position, ensuring just enough cash liquidity for essential expenses, debt repayment, and investment in growth prospects.

Cash Flow key components

Actual cash flows refer to the movement of money in and out. It is categorized in two types:

a. Cash Inflows

Cash inflows represent all the sources of money entering an enterprise, and these include:

i. Revenue:

The positive cash flow for most businesses is generated from sales of goods or services.

ii. Loans:

New borrowing of cash coming from external lenders to finance operations or expansion.

iii. Investments:

Cash from investors who purchase equity in capital purchases and long-term investments.

iv. Sale of Assets:

Cash is obtained from selling non-cash items, such as equipment or property.

b. Cash Outflows

Cash outflows, on the other hand, encompass all the expenses, cash payments, and financial obligations that lead to money leaving the business.

i. Operating Expenses

Regular expenses such as utility bills such as payroll, and rent.

ii. Purchases:

Cash is paid for raw materials or inventory.

iii. Debt Payments:

Money used for loan payments and interest.

iv. Capital Expenditures:

Cash is spent on capital assets, like machinery or infrastructure.

Cash Flow Budget Estimates

Relying on historical data, market trends, and sound judgment, enterprise owners and financial managers can forecast long-term cash budgets and safeguard against negative cash flow. Key factors to consider during cash flow budget estimates include:

-

Sales Projections:

Analyze past sales data and current market conditions to project future sales. Take into account seasonal fluctuations, market trends, and potential changes in customer behaviour.

-

Accounts Receivable and Payable:

Assess the average time it takes for farm business customers to pay their bills, long-term or short-term borrowing, and determine the time your business takes to pay its suppliers. Delayed payments from customers or earlier payments to suppliers can significantly impact cash flow and will need corrective action.

-

Inventory Management:

Balance the need to maintain sufficient inventory levels.

-

Expense Control:

All expenses and identify areas where budgeting measures can be implemented without compromising operational efficiency.

-

Contingency Planning:

Prepare for unexpected events that might impact cash flow.

Creating a cash flow budget template

Filling out the cash flow budget template is quite simple. Consider only the estimates and not the exact amount of cash flow. The budget serves as a guide to plan ahead for a business budget.

The Entity Name is found in the topmost entry in the cash flow budget, and we’ll name it” Bob’s Gym”. Next is the Period. This is where you can emphasize what you are forecasting in a certain time frame.

Generally, you start by projecting the flow budget first for a single year, then monthly. It is important to insert your logo in the cash flow budgeting template. Its primary purpose is to exhibit professionalism.

Next, we’ll fill in and calculate the income portion. This income portion can be adjusted based on your estimates. Working with the gym, considering each membership value is $12 per week, the projected monthly income will be $48 in total. Let’s say in July there’s going to be 200 members and the following month.

However, some areas would vary depending on the season of your business. You may want to start with a smaller quantity if it is pioneering. Say, for example, for the first month, that is, July, we plan to get 100 members, then it eventually increases to 120, then 150 up to December.

Around January next year, the numbers will be projected to boost due to the New Year’s resolution season. This period will signal a marketing drive for you. The numbers will dip again as the season of New Year’s resolution fades away. This cycle is projected to happen throughout the year.

This theory will help you plan your marketing drive. It is best to identify the best and worst season timing of your business.

In our sample Gym template, we have one variable: the Membership rate. Although there are other avenues and variables like sales membership or sales personal training, this will still vary depending on your status. Most often, these variables are quantitative

The estimate of sales is calculated through a formula. Ensure that you are projecting a realistic estimate of sales.

Next is the Direct costs, which are the expenses that vary with the same price and number of sales. Since a gym is mostly fixed expenses, the direct expenses will be quite minimal. In other scenarios, such as retailing, the most immediate expenditures will be 5% of the actual sales price. This makes the direct cost and sales equally proportionate in the formula.

In April, we’re going to project a spike in sales since, after Easter, the consumption of chocolates will increase. These consumers will turn to joining a gym to lose the weight gained. The increase in membership sales will proportionally increase the direct expenses and sales.

When the sales increase, we maximize the margin to get the gross earning and obtain enough income. The gross earnings vary every month depending on the sales, direct costs, and gross earnings percentage. Since our constant percentage for direct expenditure is 5%, the gross sales will always be at 95%.

Initially, for the first few months, the gross earning margin will be 90% due to increased marketing efforts for the launch. Each membership comes with a special offer, like a free towel or token, leading to higher expenses during the initial three months.

The gross earnings area is a variable portion of your cash flow budget. It is the percentage of cash receipts, calculated as being a percentage of the gross earnings, which is sales less direct costs divided by the total sales.

Below the line is what we call the operating expenses. These can be short-term cash budgets and are mostly fixed. Expenses like Accounting will be put as 300, cleaning 150, including the other categories we will specify and put into accounts every month.

The costs are constant no matter what your sales figures are.

Then we have the standard expenses. Expenses like rent and bookkeeping can be added to your lists. Let’s say you’re going to spend $200 a month for it. Take note that direct costs are constant, but some variable costs might change a bit over the months or several years.

Because the membership peaks in January, we will invest $1000 for January and February to boost our advertising campaign in those peak months.

Moving on to motor vehicle costs, we can itemize them into fuel, oil, registration, insurance, repairs, and maintenance. Additionally, employment expenses differ from wages for associates. Wages cover you and your associates, while salaries encompass on-site employees.

For our gym, we only have the wages for associates since it operates for 24 hours without an employee working on-site.

Superannuation in Australia is calculated as 9.5% of the combined wages of associates and other employees. We ensure our clients comply with Superannuation payments. Workcover, a portion of wages paid, typically amounts to 3% but may vary based on the industry.

Now we have come up with our total sales forecast operating expenditures. Fixed items do not change from month to month. The net earning is the gross earning less the sales forecast general expenses. This will also be your operating profit.

In our cash flow budget template, we intentionally exclude depreciation and interest since they are not direct cash flow items and not relevant to our focus on cash flow rather than profits.

However, there are essential cash flow elements that we must include, such as Loan Repayments. We will add car loans and other loans under Extra Finance and Costs. With a well-designed template, we can account for them accurately.

People often consider regular expenses when assessing cash flow from profits, but they tend to forget about loans taken for equipment, vehicles, or other needs. Therefore, factoring in loan repayments as part of our expenses is vital.

Our net cash flow is derived from subtracting financing expenses from the net profit and finalizing the basic cash flow forecast. It’s common for businesses to encounter initial losses in the first few months. Thus, it’s crucial to ensure sufficient net cash flow from income and financing to cover these losses. We have anticipated an overall first-year loss, which is acceptable given the projected growth and cash balance compared throughout the year.

The cash flow budget is vital for effective business planning. If the numbers don’t align initially, it prompts a reevaluation of your marketing strategy. After creating the cash flow budget, take some time away from it and return a day or two later for a thorough review. Always remember the cardinal rules for cash flow budgets and forecasts: be realistic and honest.

The readers, such as banks or potential financiers, can easily detect overestimated expenditure. To ensure accuracy, consider obtaining a specific example from someone with similar business financials or seek credit and advice from professionals like us at Suffer Partners, who have experience across various industries.

When starting a business, we won’t share specific client accounts, but we can provide typical income and expense ranges within your industry. By reviewing your cash flow budget, we can gauge if your estimates are above or below industry standards. Seeking industry standards will give you a clear picture of your cash flow budget direction. Reach out to us, your professional advisors at Suffer Partners, as we have access to industry standards that can guide you throughout the process.

After completing your cash flow budget, you can choose to print it as a standalone document or include it in your business plan. When your business is up and running and integrated with software like Xero, we can import the cash flow budget for you.

This allows you to track your progress and make necessary changes as you evolve. The cash flow budget is an essential upfront task when starting your business, and it continues as a dynamic document throughout your business’s lifespan.